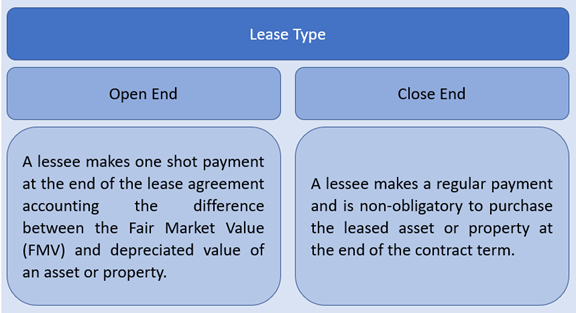

open end lease and closed end lease

A closed-end lease is a rental agreement that puts no obligation on the lessee the person making periodic lease payments to purchase the leased asset at the. Lets say your lease payments depend.

Twisted Tangle Closing After Bonita City Council Votes To End Lease

Open-end leases are typically less expensive than closed-end leases but they also come with more risk.

. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Lease renewal agreements or lease extensions are used to officially continue a rental contract before the current lease term ends. As long as you meet the mileage and condition requirements of the.

Get the residual value in the event youd like to buy the vehicle at the end of the lease. In a closed-end lease the lessor takes on the depreciation risk but the terms are more. Finally determine the total down payment and total monthly payment including taxes and fees.

In a closed-end lease the lessor takes on the depreciation risk but the terms are more. However with an open-end lease the terms are generally more flexible. However a downfall is that the lessee takes on the depreciation risk of the.

An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of. A closed-end lease is a more reliable option with a consistent payment schedule if open-end leases seem like a bit of a gamble. What is a closed end lease.

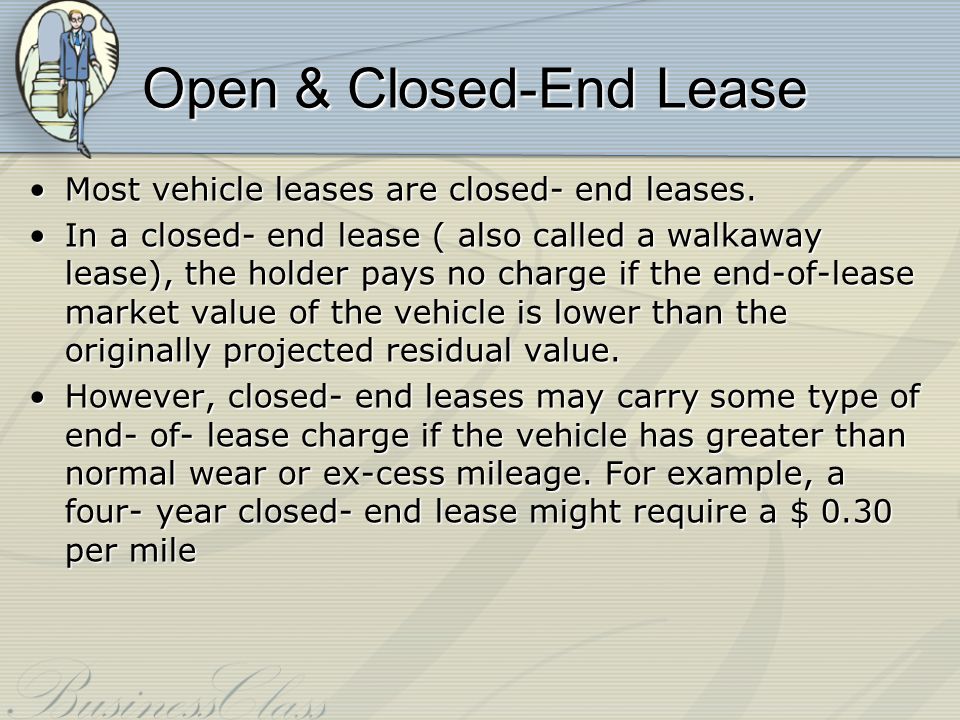

The structure of a closed-end lease has a set length usually ranging from 12 months to 48 months and comes with a fixed monthly payment and an annual mileage allotment. To help you better understand open-ended leases were inclined to provide an example to better illustrate how this type of lease works. You pay the monthly payment for the lease and in many cases can purchase the.

Although both renovation and expansion have the same. According to Credit Karma an open-end lease has. When comparing a Closed-End Lease with an Open-End Lease an Open-End Lease typically has more flexible terms.

For businesses that are more risk-averse and want to avoid unexpected costs a closed-end lease could be appropriate. With the open-ended lease you are guaranteeing the residual or buy out value of the vehicle at the end of the lease term which is structed according to your anticipated usage. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset.

An open-end lease is a contractual agreement between a lessor owner and the lessee renter that holds the lessee responsible for the value of the property. Compared to an open-end lease closed-end lease costs are much more predictable. On a closed end lease the leasing company calculates a conservative residual value based on the lowest possible level of risk to the leasing company.

While an open end lease is set up so that the risk is largely associated with the lessee a closed end lease is generally situated as to have the risk be assumed by the leasing. Closed-end leases have set term limits mileage. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency.

For example if your lease early termination payoff is 16000 and the. While you will most likely be offered a closed-end lease whenever you lease a new car an open-end lease can be an option.

How To Get An Open End Lease For Your Next Car Yourmechanic Advice

Luxury Cars Lease Specials Actionable Tips

Open End Versus Closed End Lease Ricks Free Auto Repair Advice Ricks Free Auto Repair Advice Automotive Repair Tips And How To

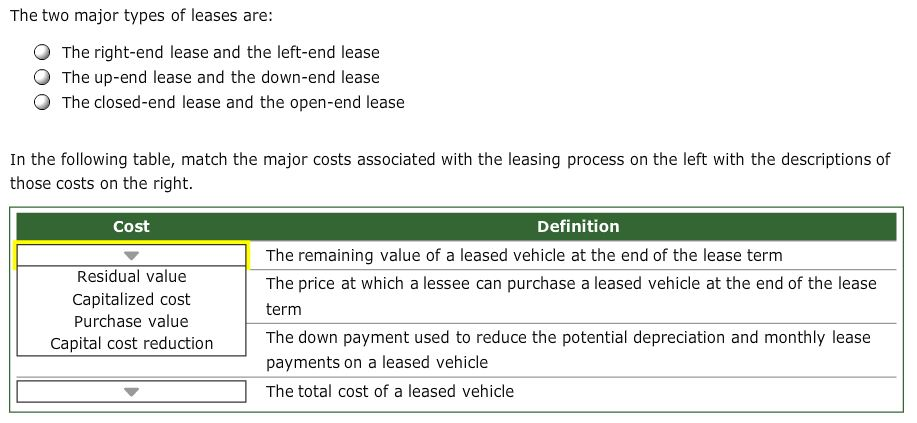

Solved The Two Major Types Of Leases Are O The Right End Chegg Com

Open End Vs Closed End Lease Jim Peplinski Leasing Inc

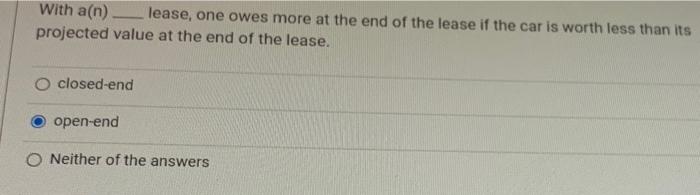

Solved With A N Lease One Owes More At The End Of The Chegg Com

Leasing A Car Is It A Good Idea Autotrader

Lease Definition Meaning In Stock Market With Example

Welcome To Ventura Volkswagen A Premium Volkswagen Dealer In Ventura

What S The Difference Between Open End And Closed End Car Leases

What Are The Different Types Of New Car Leases Part 6 Of 11

Automotive Fleet Leasing Market Size Share Opportunities Forecast

How Will You Get There Chapter 12 Ppt Download

Quiz 3 Questions And Answers Quiz 3 Name Dezarae Johnson Class Time 10 30 Am 12 50 Pm What Are Studocu

Lease Buyout 5 Tips On Buying Your Leased Car Bankrate

:max_bytes(150000):strip_icc()/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)